do you 1099 a non profit|Information returns (Forms 1099) : Clark Your nonprofit company reports the money you pay your employees on their W-2 forms. If you pay at least $600 to a non-employee during the tax year, you . The FasciaBlaster® was designed, engineered, and manufactured by Ashley Black. It is the #1 selling tool for opening fascia at the deeper layers and breakin.

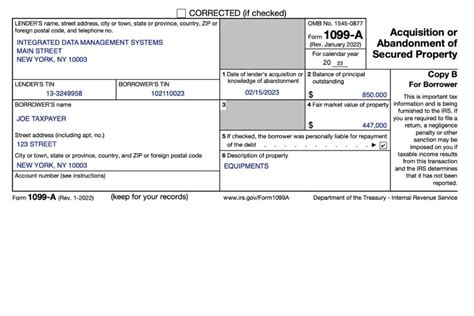

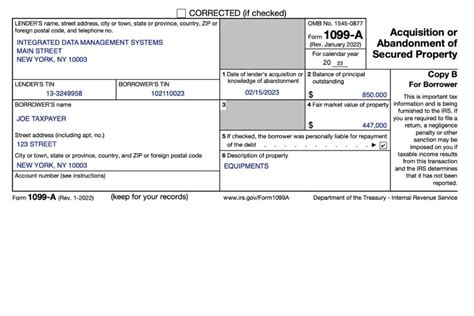

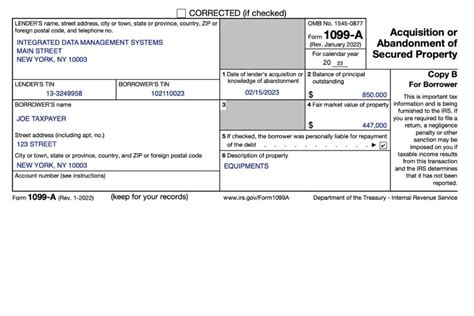

do you 1099 a non profit,E-file Form 1099 with the Information Returns Intake System (IRIS) for tax year 2022 and later. The tax-exempt organization will need the social security number or EIN of an independent contractor to complete Form 1099-MISC. 1099 For Nonprofits. You must go through multiple responsibilities and tasks as a nonprofit professional. With your primary focus dedicated to accomplishing your . IRS Form 1099 is, in short, the tax form used to report miscellaneous income to the IRS. In most cases, your nonprofit is the one who is paying, and so you will have to submit the related forms to the . When do nonprofits need to issue 1099 forms? You’ll need to issue a form 1099 if the following 4 conditions are met: You made a payment to someone who is not your employee for services rendered. . Your nonprofit company reports the money you pay your employees on their W-2 forms. If you pay at least $600 to a non-employee during the tax year, you .

Generally, 1099s are required if the amount paid is at least $600 in a year, although there are some exceptions for other forms of income. Manage your accounting, reporting, and more with Aplos. .

Am I Required to File a Form 1099 or Other Information Return? | Internal Revenue Service. 10 or more returns: E-filing now required. Starting tax year 2023, if .

Learn about making charitable contributions of property. Exempt organization types. Charitable Organizations — IRC 501 (c) (3) Organizations that are .do you 1099 a non profit Information returns (Forms 1099) For nonprofits, the most common is the 1099-MISC, used to report payments made to individuals or unincorporated businesses for services provided. This includes . Previously, you only received a 1099-K if you received over $20,000 from third-party payment platforms or electronic transactions. Starting in 2023, that amount drops to just $600. Nonprofit volunteers, staff members, and fundraisers commonly accept electronic payments on behalf of the nonprofit. Now, they could be taxed on those .

Nonprofits must file 1099-MISC forms for any individuals or businesses that they paid at least $600 in a calendar year so the IRS can track this income. This includes payments made for services, rent (apart . Beginning in January, 2021, the 1099-NEC form will now be used for reporting nonemployee compensation (NEC) payments. Previously, this was noted in a box on the 1099-MISC form. .

1099-R: Pertains to distributions from retirement plans. Preparing 1099s. Each type of 1099 form necessitates a separate Form 1096 cover sheet. You must use official IRS 1099 forms – forms printed from online are not acceptable. Form W-9 is critical for gathering the required information from vendors. The due date for 1099-NEC is .Information returns (Forms 1099) A 1099 reporting situation implies self-employment, which this is definitely not. Reply. Angela says: November 10, 2015 at 3:20 pm. . I work for a non-profit organization that has several for-profit entities under the umbrella of the non-profit. Also under this umbrella, is another ‘entity,’ that we track differently via Classes, but it . Question: I serve on the Board of Directors of a nonprofit organization that reimburses Board members and volunteers for travel and related expenses for certain organization meetings and events.Only expenses necessary to attend the meeting and event are reimbursed, and receipts are required for reimbursement. Is the organization .

Here are the penalties you’ll encounter: $30 penalty for filing a 1099 less than 30 days late. $60 penalty for filing a 1099 more than 30 days late and before August 1. $100 penalty for filing a . A recipient may use grant funds for room, board, travel, research, clerical help or equipment, that are incidental to the purposes of the scholarship or fellowship grant. b. The grant qualifies as a prize or award that is excludible from gross income under Internal Revenue Code section 74 (b), if the recipient is selected from the general public.

Tip #1 – Exclude travel reimbursements made under an accountable plan. Instructions for Form 1099-MISC say you must report in Box 7 a reimbursement made to a nonemployee if the nonemployee did NOT provide documentation of the expense under an accountable plan. For example, if you paid a speaker an honorarium of $500 plus air . An entity you operate for gain or profit; A non-profit organization, including 501(c)3 and (d) organizations; A trust of a qualified employer pension or profit-sharing plan; A non-exempt farmers’ cooperative; A widely held fixed-investment trust; . When and Where Do I File 1099-MISC Forms?do you 1099 a non profitMy understanding is we do not need to issue 1099-MISC to any corporations (except for attorney fees). . You should request the non-profit organization complete and sign a Form W-9 which certifies its tax exempt status. You can certainly report the rents if you wish, but you are not obligated to report rents or other payments to tax exempt . You can check an organization's eligibility to receive tax-deductible charitable contributions (Pub 78 Data). You can also search for information about an organization's tax-exempt status and filings: Form 990 Series Returns. Form 990-N (e-Postcard) Pub. 78 Data. Automatic Revocation of Exemption List. Thus, it is likely that the cash grants paid by your organization to financially distressed families qualify as non-taxable gifts under Section 102 and therefore should not be reported on Form 1099. For information on whether a Form 1099 must be issued for a grant made to a nonprofit organization, check out Q&A #96. Form 1099-K is a tax form used to report certain electronic and credit card payment transactions. The form includes the annual gross amount of all reportable payment transactions made through an individual payment card processor or third-party payment network. The IRS recently postponed the lowering of the reporting threshold for third . A party, committee, association, fund or other organization organized and operated primarily for the purpose of directly or indirectly accepting contributions or making expenditures, or both, for an exempt function. Other nonprofits. Organizations meeting specified requirements may qualify for exemption under subsections other than Section .For more information regarding reporting non-employee compensation and exception to reporting refer to the Instructions for Forms 1099-MISC and 1099-NEC PDF. If you file Forms 1099-NEC on paper you must submit them with Form 1096, Annual Summary and Transmittal of U.S. Information Returns. If you file more than one type of information . Trusts and nonprofit organizations are usually exempt from taxes, so you don't need to send them a 1099 form. However, if you're a tax-exempt organization, you must fill out and send this form to .January 7, 2015. The requirements for preparing and filing information returns, such as Federal Forms 1099 and W-2, apply to all businesses, including Exempt Organizations. In fact, on page 5 of the Form 990, Return of Organization Exempt from Income Tax, there are questions that must be answered as to the number of Forms W-2, W-2G and 1099 .

do you 1099 a non profit|Information returns (Forms 1099)

PH0 · What Are the Nonprofit 1099 Rules?

PH1 · Understanding 1099 For Non

PH2 · Information returns (Forms 1099)

PH3 · How to Provide a 1099 Tax Form From a Nonprofit Corporation

PH4 · Form 1099 for Nonprofits: How and Why to Issue One

PH5 · Do Nonprofits or Churches Need to Complete 1099s?

PH6 · Charities and nonprofits

PH7 · Am I Required to File a Form 1099 or Other Information Return?

PH8 · 1099s

PH9 · 1099 Best Practices for Your Nonprofit